Live Your Retirement

Here's What We Are Getting Up To

- Home

- News

Latest Hawthorns stories

Happy St David’s Day from the Hawthorns Clevedon

The Hawthorns Clevedon is a vibrant, inclusive retirement community perfectly positioned on the seafront in the....... Read More

War Stories at the Hawthorns Braintree

Many incredible war stories have been told over the years, and the Hawthorns Braintree is....... Read More

Proud Sponsors of Clevedon Pier 2024

As long-time supporters of Clevedon Pier, the Hawthorns Clevedon and Poets Mews Care Home in....... Read More

A Burns Night to Remember

Residents at the Hawthorns Clevedon embraced the spirit of the Scottish Highlands for their Burns....... Read More

Happy New Year at the Hawthorns Clevedon

Residents at the Hawthorns Clevedon celebrated the New Year in true Hawthorn’s style. The evening....... Read More

The Hawthorns Braintree Holds Festive Christmas Card Competition

As the festive season approached, the Hawthorns Braintree held a Christmas card competition and invited....... Read More

A Family Christmas at the Hawthorns Clevedon

Residents and loved ones came together for a magical day at the Hawthorns Clevedon to....... Read More

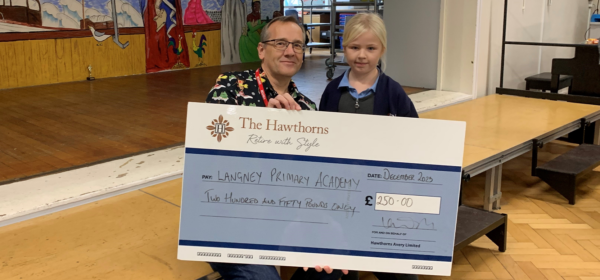

The Hawthorns Eastbourne Spreads Festive Cheer with a Christmas Card Competition

As the festive season approaches, staff and residents at the Hawthorns Eastbourne were delighted to....... Read More

A Spooktacular Halloween Party

The Hawthorns Clevedon is a vibrant, inclusive retirement community perfectly positioned on the seafront in the....... Read More

An Enchanting Evening at the Hawthorns Clevedon

Residents and guests at the Hawthorns Clevedon were treated to a magical evening of musical....... Read More